Series on Costs of Running an Industrial Facility

Part III Benefits of Governmental Incentives

Part I and Part II of this series focused on labor cost differences and utility costs across different areas of the market which are some of the most important cost inputs for businesses in the industrial sector. This series will hopefully give you insight on why I will make a great advisor to your company. Part III will examine something that’s often overlooked when moving locations and is a large opportunity to offset your capital investment into a new plant.

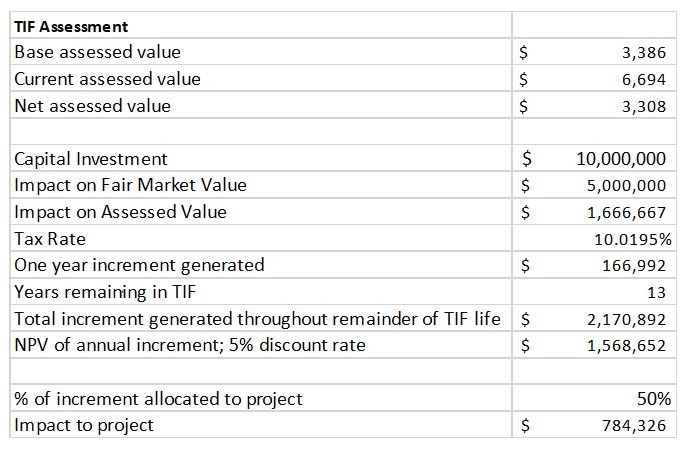

These governmental incentives can come in all different forms but for the purposes of this piece we’re going to focus on Illinois incentives and TIFs since they’re some of the most common things we’ll run into locally here. Let’s start with TIF which stands for tax increment financing. TIFs are enacted by the local municipalities to spur activity in a certain area and while they can be used with existing buildings or new developments, they usually are most effective when building a new facility. The reason a new development is the most effective form of TIF is because the money you receive will be calculated based on the additional property tax generated by the development. Going from land to a brand new building generates the largest amount of new tax revenue for the municipality. All TIFs are structured differently, but what you most often see is the municipality split the value with the end occupier over the life of the TIF. Let’s take a look at a fictional example of a $10,000,000 investment into a new facility on land that is currently undeveloped.

As you can see in the above example the public-private partnership can be quite valuable to the bottom line and offsetting out of pocket costs for a project of large scale.

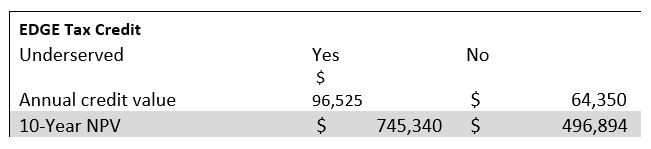

Another well-known incentive in Illinois is the EDGE Tax Credit for new job creation most businesses are very familiar with EDGE Tax Credits as they get money back for new job creation at a new facility. The biggest thing to keep in mind is that areas marked as economically underserved have massive upside in EDGE Tax credits as the state will amplify the value of these tax credits. Let’s take a fictional example of hiring 50 new employees over a two year period at an average annual salary of $52,000.

As you can see there is a 50% increase in the value of the EDGE Tax credits in underserved areas vs. non underserved. When people hear underserved, they sometimes equate it to less secure however you’ll be surprised to find how many areas are actually marked “underserved” throughout Illinois. Take a look at this map and you’ll be surprised to see how many areas close to you can amplify your incentives structure.

Let’s now take a look at a WI specific incentive that is one of the best for profitable manufacturing companies. The Wisconsin Manufacturing and Agriculture Credit effectively reduces the corporate income tax rate for manufacturing companies to almost zero (0.4%). For a company making $3,000,000 a year in net income moving from Illinois to over the border that translates into a post-tax income of $2,988,000 vs. $2,790,000 in IL ($198,000 in annual savings).

There are many more types of government incentives including enterprise zones, opportunity zones, property tax abatements, 6B tax incentive, Class 8 tax incentives and others. WI has its own version of EDGE as does IN and most other states. Every transaction is different which is why I’m here to help guide you through these lucrative, but complicated transactions. Cawley does offer consulting services to secure government incentives for companies going through expansion in addition to the brokerage and property management services it was founded on.

Call me today to discuss how we can assist your company with everything involved in expanding your operation!